Estate Planning

At Peak Financial Guidance, we believe a comprehensive financial plan isn’t truly complete without a thoughtful, legally secure estate strategy. Protecting what you’ve built and ensuring your wishes are carried out shouldn’t feel overwhelming or costly. That’s why we’ve partnered with Wealth.com to provide a streamlined, accessible estate planning solution—making it easier than ever to put the right protections in place for you and your family.

Why Estate Planning Matters

Estate planning isn’t just for the ultra-wealthy—it’s for anyone who wants to ensure their wealth, property, and wishes are handled properly. Without an estate plan:

Your assets could be tied up in probate, leading to delays and unnecessary costs.

Your family may face legal and financial complications when managing your estate.

Important healthcare and guardianship decisions could be left to the courts instead of your chosen representatives.

When to update your estate plan

• You get married or divorced

• You have or adopt a child

• A child turns 18

• A beneficiary, executor, or guardian passes away

• You’ve had a significant change in a relationship with someone named in your plan

• Your financial situation changes substantially—either an increase or decrease in wealth

• You move to a new state with different estate laws

• You start a business or acquire a major asset

• You want to clarify or redefine the legacy you wish to leave

Keeping your estate plan up to date ensures everything remains aligned with your goals, your family’s needs, and any legal requirements that may change over time.

Let’s Get Started

A Smarter Way to Plan Your Future

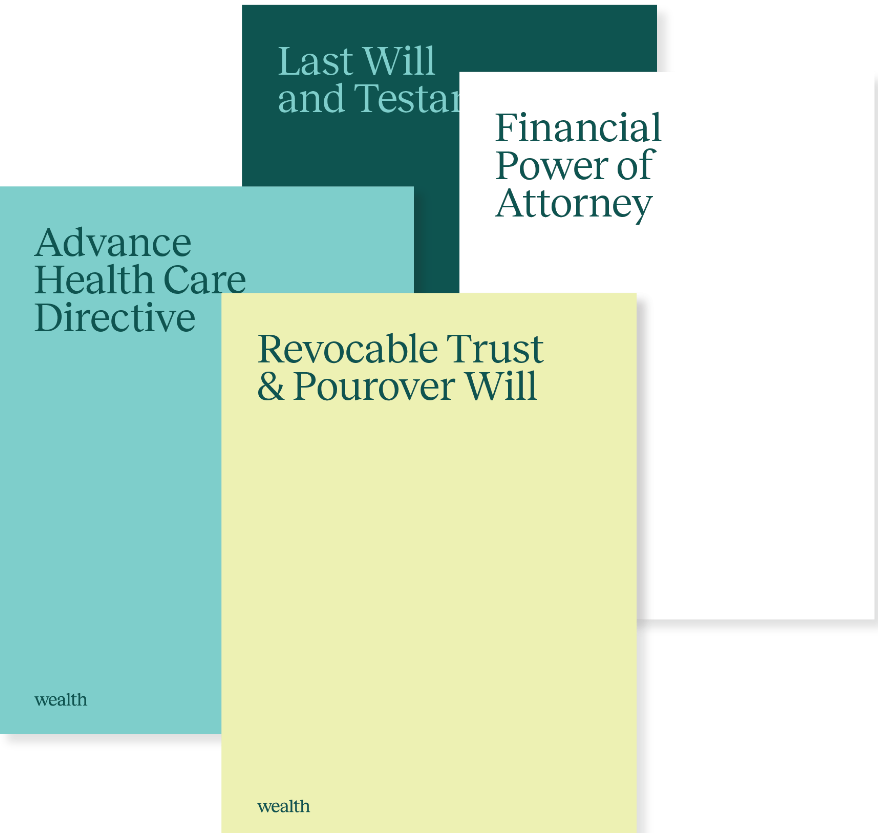

Through our partnership with Wealth.com, we now provide clients with a secure, AI-powered estate planning platform that makes it easier than ever to create and manage a legally valid estate plan—without the traditional high costs or hassle.

Create a will, trust, power of attorney, and other key documents in minutes

Seamlessly integrate your estate plan with your financial plan for a complete picture

Easily update your plan as life changes, ensuring it always reflects your wishes

Share securely with your family and trusted advisors

That Estate planning is a critical part of protecting your wealth and your family’s future. As your trusted advisor, we’re here to help make the process simple, secure and stress-free.

Get Started today by scheduling a conversation with our team.

Peak Financial Guidance LLC does not provide legal advice. Through a partnership with wealth.com, clients of Peak Financial Guidance LLC are able to create their own legal documents through guided process with wealth.com. Peak Financial Guidance LLC cannot help in selecting legal documents nor draft legal documents on a clients behalf and may not apply the law to a clients situation.

Estate Planning

At Peak Financial Guidance, we believe a comprehensive financial plan isn’t truly complete without a thoughtful, legally secure estate strategy. Protecting what you’ve built and ensuring your wishes are carried out shouldn’t feel overwhelming or costly. That’s why we’ve partnered with Wealth.com to provide a streamlined, accessible estate planning solution—making it easier than ever to put the right protections in place for you and your family.

A Smarter Way to Plan Your Future

That Estate planning is a critical part of protecting your wealth and your family’s future. As your trusted advisor, we’re here to help make the process simple, secure and stress-free.

Get Started today by scheduling a conversation with our team.

Peak Financial Guidance LLC does not provide legal advice. Through a partnership with wealth.com, clients of Peak Financial Guidance LLC are able to create their own legal documents through guided process with wealth.com. Peak Financial Guidance LLC cannot help in selecting legal documents nor draft legal documents on a clients behalf and may not apply the law to a clients situation.

Through our partnership with Wealth.com, we now provide clients with a secure, AI-powered estate planning platform that makes it easier than ever to create and manage a legally valid estate plan—without the traditional high costs or hassle.

Create a will, trust, power of attorney, and other key documents in minutes

Seamlessly integrate your estate plan with your financial plan for a complete picture

Easily update your plan as life changes, ensuring it always reflects your wishes

Share securely with your family and trusted advisors